Bothell Beer Festival

Celebrate great beers & ciders, delicious food, and music at the 5th annual Bothell Beer Festival this Saturday, Oct 6th from 12pm-6pm! Bring your friends and come experience this cool rain-free industrial environment! http://bothellchamberwa.chambermaster.com/events/details/bothell-underground-beer-festival-2018-13716

WEALTH BUILDING OPPORTUNITIES FOR FIRST-TIME HOME BUYERS ABOUND

|

|

Leavenworth Oktoberfest

There’s no better way to kick off the month of October than in Leavenworth for their annual Oktoberfest! 4 venues – 3 weekends of fun for the entire family! “It’s the next best thing to being in Munich!” For more information and to schedule your weekend getaway, check it out here 👉http://www.leavenworthoktoberfest.com/

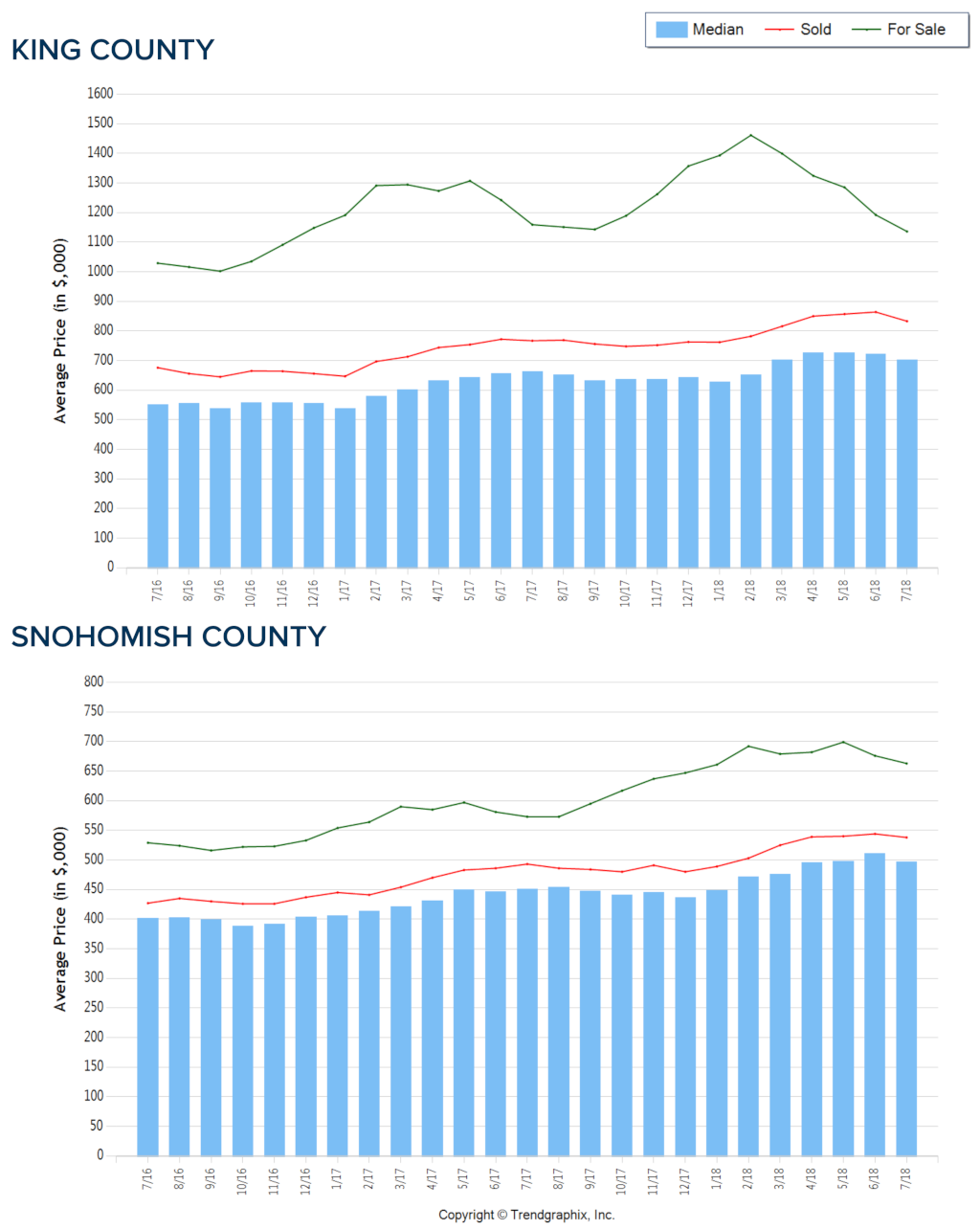

Keeping Price Growth in Perspective, Opportunities Abound for Both Buyers and Sellers

|

|

|

Don’t Wait for a Disaster to Build Your Emergency Kit

Two Weeks Ready: Be Prepared. Build Kits. Help Each Other.

The first few days after a disaster are often the most critical. Government and essential services may not be available right away, depending on the circumstances. It is imperative to have a plan in place for such a time, and be ready to act on your own.

Washington’s biggest disaster threat is from earthquakes. Washington State’s Emergency Management Division advises that we take precautions to be on our own for at least 2 weeks. Take a look at their Two Week Ready Brochure (PDF) that outlines the basics necessary for your emergency kit. While it is important to get ready, don’t feel like you have to do it all at once. The list of necessities is long, so take a look at the agency’s year-long prep plan. You will also find information on pet preparedness, as well as the agency’s Drop, Cover, and Hold Earthquake Scenario map.

What’s in Your Toolbox to Navigate the Changing Market?

The late spring market brought about some welcomed change to our local real estate markets. In May, we experienced the largest increase in inventory in a decade! North King County and South Snohomish County are two examples of what is happening in all the markets across the Puget Sound as we head into the second half of 2018. Below is a breakdown of the current environment; further is an explanation of what it all means.

North King County (Ship Canal to Snohomish County Line):

- 38% increase in new listings from April to May 2018

- 16% more new listings in May 2018 vs. May 2017

- Overall 5% more new listings over the last 12 months vs. the previous 12 months

- Average list-to-sale price ratios reduce to 104% from 105% in May 2018

- Median Price up 15% complete year over year, but down 1% vs. the previous month, landing at $815K.

South Snohomish County (Snohomish County Line to Everett):

- 27% increase in new listings from April to May 2018

- 10% more new listings in May 2018 vs. May 2017

- Overall 2% more new listings over the last 12 months vs. the previous 12 months

- Average list-to-sale price ratios reduce to 102% from 103% in May 2018

- Median price up 12% complete year over year, but equal with the previous month, landing at $500K.

This increase in inventory is awesome! It is providing more selection for buyers and is helping temper price growth, which was increasing at an unsustainable level. It is still a Seller’s market by all means, which is defined by having three or less months of available inventory. Both market areas are still just under one month of inventory based on pending sales, but not as low as the two-week mark they were experiencing in March.

The increase in inventory is the result of pent up seller demand. From 1985-2008 the average amount of time a homeowner stayed in their home was 6 years. From 2008-2017 it grew to 9 years. With a resounding amount of equity under their belts, many homeowners are now deciding to make moves. Some are moving up to the next best thing and others are cashing out and leaving the area for a new beginning or retirement. This is providing buyers with the selection they have been waiting for after a very tenuous, inventory-starved start to 2018. The buyers that have stayed on the forefront of the market are now being rewarded with choices. These choices are best accompanied with keen discernment in order to craft the best negotiations – the broker they choose to align with is key.

The price analysis above indicates strong equity positions for sellers, but also a leveling off in price growth. Over the first quarter we saw prices increase month-over-month quite handily; now that more inventory is appearing and demand is being absorbed, price growth is not as extreme. This has highlighted the importance of having a strategic pricing and marketing plan for sellers wanting the highest price and shortest market time. The broker they choose to align with is key.

The importance of both buyers and sellers aligning with a knowledgeable, well-researched and responsive broker is paramount. One might think that it is “easy” to sell a house in this market, but the pricing research, home preparation, market exposure, varied marketing mediums, close management of all the communication, and how negotiations are handled can make or break a seller’s net return on the sale. With market times increasing, having a broker with a tight grasp on the changing environment will help create an efficient market time, resulting in the best price and terms for a successful closing. It is important that sellers do not overshoot this market, and it takes a broker with a keen gut sense rooted in in-depth research to help get them their desired results.

If you’re a buyer, it is overwhelmingly important that you are aligned with a broker that knows how to win in this market. The increase in selection has left some room for contemplation in some cases. Considering possible terms and price based on thorough market research as you head into negotiations are what set a highly capable selling broker apart and are required to prevail. With more selection coming to market, buyers have more to consider, and having a broker alongside them to help craft a strategy of negotiations will ensure they don’t overpay.

If you have any curiosities or questions regarding the value of your current home or purchase opportunities in today’s market, please contact me. It is my goal to help keep you informed and empower strong decisions.

Where to Watch Fireworks 2018

The Fourth of July is right around the corner.

The Fourth of July is right around the corner.

With it being on a Wednesday, keeping it local makes sense.

Here is a list of local firework shows to help you celebrate the great U.S. of A!

Bellevue – Downtown Park 10:05 p.m.

Des Moines – Marina 10:20 p.m.

Edmonds – Civic Stadium 10 p.m.

Everett – Port Gardner Bay 10:20 p.m.

Federal Way – Celebration Park 10:15 p.m.

Kent – Lake Meridian Park 10 p.m.

Kirkland – Marina Park 10:15 p.m.

Lakewood – Joint Base Lewis-McChord 10 p.m.

Newcastle – Lake Boren Park 10 p.m.

Renton – Coulon Park 10 p.m.

SeaTac – Angle Lake Park 10 p.m.

Seattle – Lake Union 10:20 p.m. BIG!

Tacoma – Ruston Way 10:10 p.m. BIG!

Tukwila – Fort Dent Park 10 p.m.

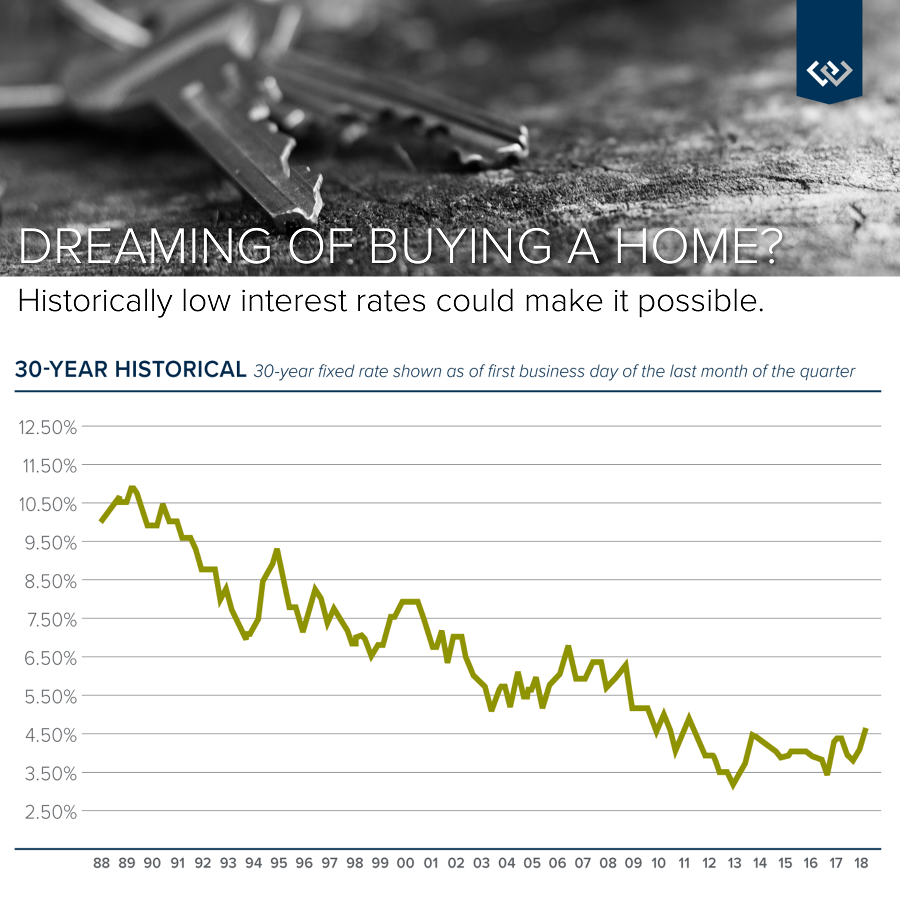

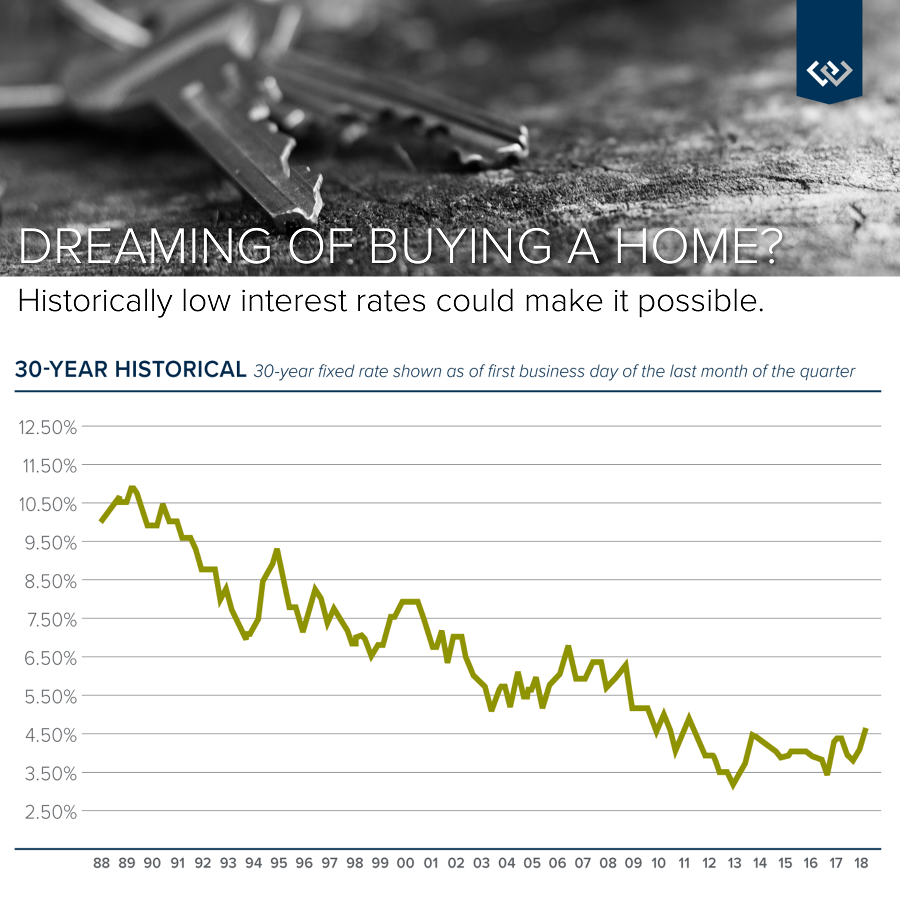

Interest rates on all time low!

The long-term loan interest rate remains historically

low, however it has made a slight jump

since the first of the year. Over the last 13-months

rates have gone from 4.25% to 4.625% with

experts predicting a rise to 4.95% by the end of the year

. Keep in mind this recent jump is still

well below the 30-year average of 6.57%

Right now is one of the most advantageous times to mak

e a purchase because the debt service

is so low. This has helped off-set the price appreciation

we have seen in our area. Move-up,

second home, investment, and down-size purchases are all

supported by today’s interest rate. If

you are currently sitting on a higher interest rate you

may want to consider a refinance,

especially if you plan to stay in your home for a while.

I have a list of preferred lenders that are responsive, reputable and competitive. If you’d like a

referral or have any questions about how today’s interest

rate may affect your bottom line

please contact me. It is my goal to help keep my client

s informed and empower strong decisions.

Does it make more sense to rent or own?

The current break-even horizon* in the Seattle metro area is 1.6 years!

*The amount of time you need to own your home in order for owning to be a superior financial decision.

With rising rental rates, historically low interest rates, and home prices on the rise, the advantage of buying vs. renting is becoming clearer each month.

In fact, Seattle has seen some of the sharpest rent hikes in the country over the last year! Snohomish County has seen a huge increase in apartment growth and rising rental rates as well. There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. Zillow Research has determined the break-even point for renting vs. buying in our metro area. In other words, the amount of time you need to own your home in order for owning to be a superior financial decision. Currently in Seattle the break-even point is 1.6 years – that is quick! What is so great about every month that ticks away thereafter is that your nest egg is building in value.

I am happy to help you or someone you know assess your options; please contact me anytime.

These assumptions are based on a home buyer purchasing a home with a 30-year, fixed-rate mortgage and a 20 percent down payment; and a renter earning five percent annually on investments in the stock market.

Why we are NOT headed toward another housing bubble

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link