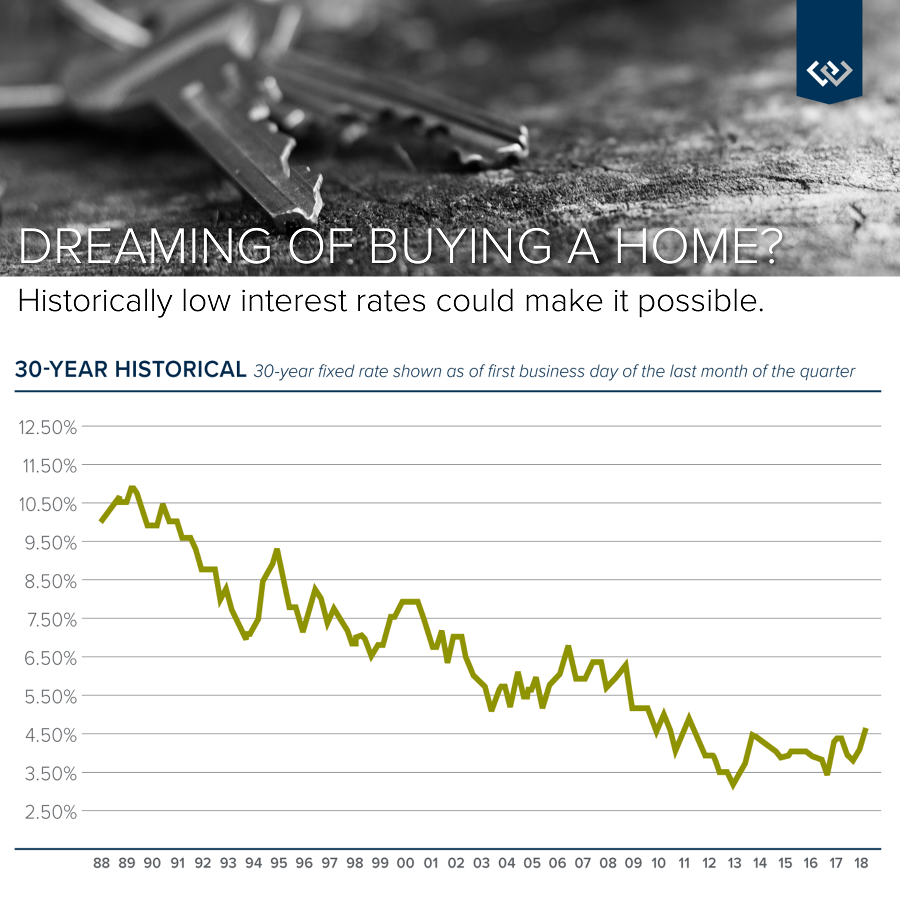

The long-term loan interest rate remains historically

low, however it has made a slight jump

since the first of the year. Over the last 13-months

rates have gone from 4.25% to 4.625% with

experts predicting a rise to 4.95% by the end of the year

. Keep in mind this recent jump is still

well below the 30-year average of 6.57%

Right now is one of the most advantageous times to mak

e a purchase because the debt service

is so low. This has helped off-set the price appreciation

we have seen in our area. Move-up,

second home, investment, and down-size purchases are all

supported by today’s interest rate. If

you are currently sitting on a higher interest rate you

may want to consider a refinance,

especially if you plan to stay in your home for a while.

I have a list of preferred lenders that are responsive, reputable and competitive. If you’d like a

referral or have any questions about how today’s interest

rate may affect your bottom line

please contact me. It is my goal to help keep my client

s informed and empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link